Medical Adhesives Market Overview:

According to the U.S. National Library of Medicine and National Institute of Health, human skin wounds are major threat to public health. Every year, chronic wounds result in a financial loss of about $25 billion with around 6.5 million patients in United States of America alone.[1] Wound closure is performed by using medical adhesives that are made by using natural or synthetic materials which not only helps in closing of a wound but also prevents infections from spreading. The market is segmented on the basis of formulating technology into water, solid and hot melt, and solvent based as medical adhesive requirement varies according to wound type. In 2018, revenue of medical adhesive market accounted $9.59 billion globally, the market is anticipated to expand at a CAGR of 8.34% during the forecast period of 2019-2025.

Medical Adhesives Market Outlook

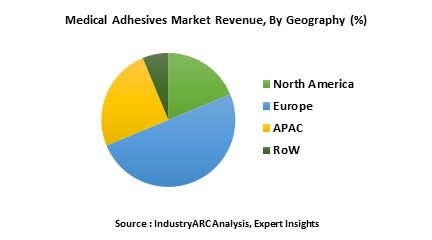

There are several different methods of closing a wound once the surgery is performed on a person. Closing a wound is necessary as an open wound is an unbound invitation for a majority of bacteria and viruses that can cause harmful infections in the entire body. Closure of wounds is now majorly performed with the use of medical adhesives as they do not require additional strength for healing as compared to sutures and staples. There are many different applications of medical adhesives including medical adhesive tape, skin adhesive, medical adhesive spray, medical adhesive glue, and medical skin glue. Medical adhesives are of two different types- natural resin type which can be divided into collagen, fibrin, and albumin, and synthetic and semi-synthetic type which can be divided into Acrylic, Cyanoacrylate, Epoxy, Silicone, and Poly Ethylene Glycol. Collagen is the most prominently used medical adhesive material and this application segment is evaluated to grow with a CAGR of 7% during the forecast period of 2019-2025. Since North America houses Hollywood and a plethora of social media influencers and celebrities, medical adhesives are being increasingly applied in cosmetic surgeries which are being solicited for improvement of aesthetic appearance. This is the reason why North America held the maximum demand share in the global medical adhesives market with a regional share of 44% in the year 2018.

Medical Adhesives Market Growth Drivers:

Ø Rising Incidences of Road Accidents

According to the World Health Organization’s statistics on road traffic crashes, approximately 1.35 million accident deaths are recorded every year.[2] More than half of these occur in countries which are categorized under low and middle income economies. A relentless number of surgeries take place because of these road accidents which has provided impetus to the medical devices market as these wounds need to be closed to prevent spreading of deadly infections.

Medical Adhesives Market Challenges:

A prominent challenge faced by the medical adhesives market is varying skin types which has limited key market players from creating a universal device. An ethical way to combat this challenge is to create a dedicated research and development team that creates customized products for all skin types in order to attract more consumers.

Medical Adhesives Market Key Players Perspective:

There has been a considerable development in the growth of medical adhesives market with key market players such as Henkel AG & Company, B. Braun Melsungen AG, 3M Company, CryoLife, Inc., Chemence Ltd., Cyberbond LLC, Ethicon Inc., Covidien Ltd., GluStitch Inc., Adhezion Biomedical, Cohera Medical, Inc., Baxter International Inc., Gem S.r.l, Meyer-Haake Gmbh, and Biocoral, Inc., and others.

Germany based Henkel AG & Company released a press release in September 2018 stating about their efforts to innovate and create flexible LED cure adhesives for medical devices in the healthcare industry.

Medical Adhesives Market Trends:

* Aquatic Organisms’ Adhesion

According to recent research by National Center for Biotechnology Information, underwater adhesion can be improved by following aquatic animals’ natural adhesion systems. This has majorly been inspired by aquatic animals such as mussels, and endoparasitic worms, where the aquatic animals’ natural adhesion systems is used in medical adhesives by improving the polymer technology.

* Customised Band-Aids

In order to make medical products more appealing to customers, key market players have been using medical adhesives in creation of customized first aid or band aids that follow a particular theme. Recently, popular medical aid companies released band-aids that featured ‘Frozen’ and ‘Star Wars’ characters in them. This generates a high demand for medical adhesives as without them band-aids are ineffective.

Medical Adhesives Market Research Scope

The base year of the study is 2018, with forecast done up to 2025. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the Medical Adhesives Market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the types of cheese in the Medical Adhesives Market, and their specific applications in different areas.

Medical Adhesives Market Report: Industry Coverage

The medical adhesives market can be segmented on the basis of natural resin type, synthetic and semi synthetic type, and formulating technology. Based on natural resin type, the market can be divided into collagen, fibrin, and albumin. By synthetic and semi synthetic type, the market can be segmented into Acrylic, Cyanoacrylate, Epoxy, Silicone, Poly Ethylene Glycol. And by formulating technology, the market can be divided into water, solid and hot melt, and solvent based.

The Medical Adhesives Market report also analyzes the major geographic regions for the market as well as the major countries for the market in these regions. The regions and countries covered in the study include:

• North America: The U.S., Canada, Mexico

• South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

• Europe: The U.K., Germany, Italy, France, The Netherlands, Belgium, Spain, Denmark

• APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

• Middle East and Africa: Israel, South Africa, Saudi Arabia

Reference:

[1] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2810192/

[2] https://www.who.int/news-room/fact-sheets/detail/road-traffic-injuries

Table 1: Medical Adhesives Market Overview 2023-2030

Table 2: Medical Adhesives Market Leader Analysis 2023-2024 (US$)

Table 3: Medical Adhesives Market Product Analysis 2023-2024 (US$)

Table 4: Medical Adhesives Market End User Analysis 2023-2024 (US$)

Table 5: Medical Adhesives Market Patent Analysis 2021-2023* (US$)

Table 6: Medical Adhesives Market Financial Analysis 2023-2024 (US$)

Table 7: Medical Adhesives Market Driver Analysis 2023-2024 (US$)

Table 8: Medical Adhesives Market Challenges Analysis 2023-2024 (US$)

Table 9: Medical Adhesives Market Constraint Analysis 2023-2024 (US$)

Table 10: Medical Adhesives Market Supplier Bargaining Power Analysis 2023-2024 (US$)

Table 11: Medical Adhesives Market Buyer Bargaining Power Analysis 2023-2024 (US$)

Table 12: Medical Adhesives Market Threat of Substitutes Analysis 2023-2024 (US$)

Table 13: Medical Adhesives Market Threat of New Entrants Analysis 2023-2024 (US$)

Table 14: Medical Adhesives Market Degree of Competition Analysis 2023-2024 (US$)

Table 15: Medical Adhesives Market Value Chain Analysis 2023-2024 (US$)

Table 16: Medical Adhesives Market Pricing Analysis 2023-2030 (US$)

Table 17: Medical Adhesives Market Opportunities Analysis 2023-2030 (US$)

Table 18: Medical Adhesives Market Product Life Cycle Analysis 2023-2030 (US$)

Table 19: Medical Adhesives Market Supplier Analysis 2023-2024 (US$)

Table 20: Medical Adhesives Market Distributor Analysis 2023-2024 (US$)

Table 21: Medical Adhesives Market Trend Analysis 2023-2024 (US$)

Table 22: Medical Adhesives Market Size 2023 (US$)

Table 23: Medical Adhesives Market Forecast Analysis 2023-2030 (US$)

Table 24: Medical Adhesives Market Sales Forecast Analysis 2023-2030 (Units)

Table 25: Medical Adhesives Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 26: Medical Adhesives Market By Type, Revenue & Volume, By By Natural Resin Type, 2023-2030 ($)

Table 27: Medical Adhesives Market By Type, Revenue & Volume, By By Synthetic & Semi Synthetic Resin Type, 2023-2030 ($)

Table 28: Medical Adhesives Market, Revenue & Volume, By Formulating Technology, 2023-2030 ($)

Table 29: Medical Adhesives Market By Formulating Technology, Revenue & Volume, By Water Based, 2023-2030 ($)

Table 30: Medical Adhesives Market By Formulating Technology, Revenue & Volume, By Solvent Based, 2023-2030 ($)

Table 31: Medical Adhesives Market By Formulating Technology, Revenue & Volume, By Solids & Hot Melt, 2023-2030 ($)

Table 32: Medical Adhesives Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 33: Medical Adhesives Market By Application, Revenue & Volume, By Bandage Tapes, 2023-2030 ($)

Table 34: Medical Adhesives Market By Application, Revenue & Volume, By Ostomy Seals, 2023-2030 ($)

Table 35: Medical Adhesives Market By Application, Revenue & Volume, By Wound Dressing, 2023-2030 ($)

Table 36: Medical Adhesives Market By Application, Revenue & Volume, By Drug Delivery Patches, 2023-2030 ($)

Table 37: Medical Adhesives Market By Application, Revenue & Volume, By Dental Applications, 2023-2030 ($)

Table 38: North America Medical Adhesives Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 39: North America Medical Adhesives Market, Revenue & Volume, By Formulating Technology, 2023-2030 ($)

Table 40: North America Medical Adhesives Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 41: South america Medical Adhesives Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 42: South america Medical Adhesives Market, Revenue & Volume, By Formulating Technology, 2023-2030 ($)

Table 43: South america Medical Adhesives Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 44: Europe Medical Adhesives Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 45: Europe Medical Adhesives Market, Revenue & Volume, By Formulating Technology, 2023-2030 ($)

Table 46: Europe Medical Adhesives Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 47: APAC Medical Adhesives Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 48: APAC Medical Adhesives Market, Revenue & Volume, By Formulating Technology, 2023-2030 ($)

Table 49: APAC Medical Adhesives Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 50: Middle East & Africa Medical Adhesives Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 51: Middle East & Africa Medical Adhesives Market, Revenue & Volume, By Formulating Technology, 2023-2030 ($)

Table 52: Middle East & Africa Medical Adhesives Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 53: Russia Medical Adhesives Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 54: Russia Medical Adhesives Market, Revenue & Volume, By Formulating Technology, 2023-2030 ($)

Table 55: Russia Medical Adhesives Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 56: Israel Medical Adhesives Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 57: Israel Medical Adhesives Market, Revenue & Volume, By Formulating Technology, 2023-2030 ($)

Table 58: Israel Medical Adhesives Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 59: Top Companies 2023 (US$) Medical Adhesives Market, Revenue & Volume

Table 60: Product Launch 2023-2024 Medical Adhesives Market, Revenue & Volume

Table 61: Mergers & Acquistions 2023-2024 Medical Adhesives Market, Revenue & Volume

List of Figures:

Figure 1: Overview of Medical Adhesives Market 2023-2030

Figure 2: Market Share Analysis for Medical Adhesives Market 2023 (US$)

Figure 3: Product Comparison in Medical Adhesives Market 2023-2024 (US$)

Figure 4: End User Profile for Medical Adhesives Market 2023-2024 (US$)

Figure 5: Patent Application and Grant in Medical Adhesives Market 2021-2023* (US$)

Figure 6: Top 5 Companies Financial Analysis in Medical Adhesives Market 2023-2024 (US$)

Figure 7: Market Entry Strategy in Medical Adhesives Market 2023-2024

Figure 8: Ecosystem Analysis in Medical Adhesives Market 2023

Figure 9: Average Selling Price in Medical Adhesives Market 2023-2030

Figure 10: Top Opportunites in Medical Adhesives Market 2023-2024

Figure 11: Market Life Cycle Analysis in Medical Adhesives Market

Figure 12: GlobalBy Type Medical Adhesives Market Revenue, 2023-2030 ($)

Figure 13: GlobalBy Formulating Technology Medical Adhesives Market Revenue, 2023-2030 ($)

Figure 14: GlobalBy Application Medical Adhesives Market Revenue, 2023-2030 ($)

Figure 15: Global Medical Adhesives Market - By Geography

Figure 16: Global Medical Adhesives Market Value & Volume, By Geography, 2023-2030 ($)

Figure 17: Global Medical Adhesives Market CAGR, By Geography, 2023-2030 (%)

Figure 18: North America Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 19: US Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 20: US GDP and Population, 2023-2024 ($)

Figure 21: US GDP – Composition of 2023, By Sector of Origin

Figure 22: US Export and Import Value & Volume, 2023-2024 ($)

Figure 23: Canada Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 24: Canada GDP and Population, 2023-2024 ($)

Figure 25: Canada GDP – Composition of 2023, By Sector of Origin

Figure 26: Canada Export and Import Value & Volume, 2023-2024 ($)

Figure 27: Mexico Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 28: Mexico GDP and Population, 2023-2024 ($)

Figure 29: Mexico GDP – Composition of 2023, By Sector of Origin

Figure 30: Mexico Export and Import Value & Volume, 2023-2024 ($)

Figure 31: South America Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 32: Brazil Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 33: Brazil GDP and Population, 2023-2024 ($)

Figure 34: Brazil GDP – Composition of 2023, By Sector of Origin

Figure 35: Brazil Export and Import Value & Volume, 2023-2024 ($)

Figure 36: Venezuela Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 37: Venezuela GDP and Population, 2023-2024 ($)

Figure 38: Venezuela GDP – Composition of 2023, By Sector of Origin

Figure 39: Venezuela Export and Import Value & Volume, 2023-2024 ($)

Figure 40: Argentina Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 41: Argentina GDP and Population, 2023-2024 ($)

Figure 42: Argentina GDP – Composition of 2023, By Sector of Origin

Figure 43: Argentina Export and Import Value & Volume, 2023-2024 ($)

Figure 44: Ecuador Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 45: Ecuador GDP and Population, 2023-2024 ($)

Figure 46: Ecuador GDP – Composition of 2023, By Sector of Origin

Figure 47: Ecuador Export and Import Value & Volume, 2023-2024 ($)

Figure 48: Peru Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 49: Peru GDP and Population, 2023-2024 ($)

Figure 50: Peru GDP – Composition of 2023, By Sector of Origin

Figure 51: Peru Export and Import Value & Volume, 2023-2024 ($)

Figure 52: Colombia Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 53: Colombia GDP and Population, 2023-2024 ($)

Figure 54: Colombia GDP – Composition of 2023, By Sector of Origin

Figure 55: Colombia Export and Import Value & Volume, 2023-2024 ($)

Figure 56: Costa Rica Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 57: Costa Rica GDP and Population, 2023-2024 ($)

Figure 58: Costa Rica GDP – Composition of 2023, By Sector of Origin

Figure 59: Costa Rica Export and Import Value & Volume, 2023-2024 ($)

Figure 60: Europe Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 61: U.K Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 62: U.K GDP and Population, 2023-2024 ($)

Figure 63: U.K GDP – Composition of 2023, By Sector of Origin

Figure 64: U.K Export and Import Value & Volume, 2023-2024 ($)

Figure 65: Germany Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 66: Germany GDP and Population, 2023-2024 ($)

Figure 67: Germany GDP – Composition of 2023, By Sector of Origin

Figure 68: Germany Export and Import Value & Volume, 2023-2024 ($)

Figure 69: Italy Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 70: Italy GDP and Population, 2023-2024 ($)

Figure 71: Italy GDP – Composition of 2023, By Sector of Origin

Figure 72: Italy Export and Import Value & Volume, 2023-2024 ($)

Figure 73: France Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 74: France GDP and Population, 2023-2024 ($)

Figure 75: France GDP – Composition of 2023, By Sector of Origin

Figure 76: France Export and Import Value & Volume, 2023-2024 ($)

Figure 77: Netherlands Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 78: Netherlands GDP and Population, 2023-2024 ($)

Figure 79: Netherlands GDP – Composition of 2023, By Sector of Origin

Figure 80: Netherlands Export and Import Value & Volume, 2023-2024 ($)

Figure 81: Belgium Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 82: Belgium GDP and Population, 2023-2024 ($)

Figure 83: Belgium GDP – Composition of 2023, By Sector of Origin

Figure 84: Belgium Export and Import Value & Volume, 2023-2024 ($)

Figure 85: Spain Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 86: Spain GDP and Population, 2023-2024 ($)

Figure 87: Spain GDP – Composition of 2023, By Sector of Origin

Figure 88: Spain Export and Import Value & Volume, 2023-2024 ($)

Figure 89: Denmark Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 90: Denmark GDP and Population, 2023-2024 ($)

Figure 91: Denmark GDP – Composition of 2023, By Sector of Origin

Figure 92: Denmark Export and Import Value & Volume, 2023-2024 ($)

Figure 93: APAC Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 94: China Medical Adhesives Market Value & Volume, 2023-2030

Figure 95: China GDP and Population, 2023-2024 ($)

Figure 96: China GDP – Composition of 2023, By Sector of Origin

Figure 97: China Export and Import Value & Volume, 2023-2024 ($) Medical Adhesives Market China Export and Import Value & Volume, 2023-2024 ($)

Figure 98: Australia Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 99: Australia GDP and Population, 2023-2024 ($)

Figure 100: Australia GDP – Composition of 2023, By Sector of Origin

Figure 101: Australia Export and Import Value & Volume, 2023-2024 ($)

Figure 102: South Korea Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 103: South Korea GDP and Population, 2023-2024 ($)

Figure 104: South Korea GDP – Composition of 2023, By Sector of Origin

Figure 105: South Korea Export and Import Value & Volume, 2023-2024 ($)

Figure 106: India Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 107: India GDP and Population, 2023-2024 ($)

Figure 108: India GDP – Composition of 2023, By Sector of Origin

Figure 109: India Export and Import Value & Volume, 2023-2024 ($)

Figure 110: Taiwan Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 111: Taiwan GDP and Population, 2023-2024 ($)

Figure 112: Taiwan GDP – Composition of 2023, By Sector of Origin

Figure 113: Taiwan Export and Import Value & Volume, 2023-2024 ($)

Figure 114: Malaysia Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 115: Malaysia GDP and Population, 2023-2024 ($)

Figure 116: Malaysia GDP – Composition of 2023, By Sector of Origin

Figure 117: Malaysia Export and Import Value & Volume, 2023-2024 ($)

Figure 118: Hong Kong Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 119: Hong Kong GDP and Population, 2023-2024 ($)

Figure 120: Hong Kong GDP – Composition of 2023, By Sector of Origin

Figure 121: Hong Kong Export and Import Value & Volume, 2023-2024 ($)

Figure 122: Middle East & Africa Medical Adhesives Market Middle East & Africa 3D Printing Market Value & Volume, 2023-2030 ($)

Figure 123: Russia Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 124: Russia GDP and Population, 2023-2024 ($)

Figure 125: Russia GDP – Composition of 2023, By Sector of Origin

Figure 126: Russia Export and Import Value & Volume, 2023-2024 ($)

Figure 127: Israel Medical Adhesives Market Value & Volume, 2023-2030 ($)

Figure 128: Israel GDP and Population, 2023-2024 ($)

Figure 129: Israel GDP – Composition of 2023, By Sector of Origin

Figure 130: Israel Export and Import Value & Volume, 2023-2024 ($)

Figure 131: Entropy Share, By Strategies, 2023-2024* (%) Medical Adhesives Market

Figure 132: Developments, 2023-2024* Medical Adhesives Market

Figure 133: Company 1 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 134: Company 1 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 135: Company 1 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 136: Company 2 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 137: Company 2 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 138: Company 2 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 139: Company 3 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 140: Company 3 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 141: Company 3 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 142: Company 4 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 143: Company 4 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 144: Company 4 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 145: Company 5 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 146: Company 5 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 147: Company 5 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 148: Company 6 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 149: Company 6 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 150: Company 6 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 151: Company 7 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 152: Company 7 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 153: Company 7 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 154: Company 8 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 155: Company 8 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 156: Company 8 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 157: Company 9 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 158: Company 9 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 159: Company 9 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 160: Company 10 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 161: Company 10 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 162: Company 10 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 163: Company 11 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 164: Company 11 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 165: Company 11 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 166: Company 12 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 167: Company 12 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 168: Company 12 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 169: Company 13 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 170: Company 13 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 171: Company 13 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 172: Company 14 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 173: Company 14 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 174: Company 14 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Figure 175: Company 15 Medical Adhesives Market Net Revenue, By Years, 2023-2024* ($)

Figure 176: Company 15 Medical Adhesives Market Net Revenue Share, By Business segments, 2023 (%)

Figure 177: Company 15 Medical Adhesives Market Net Sales Share, By Geography, 2023 (%)

Email

Email Print

Print