Online / E-grocery Market Overview:

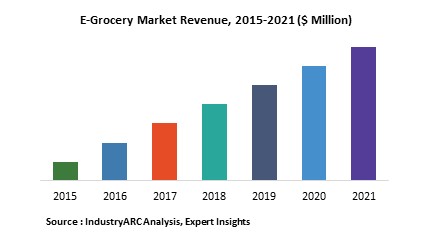

According to the US Department of Agriculture, more than 25 million Americans do not have access to a grocery store in their residential vicinity. These citizens lack access to nutritious food and often rely on packaged products for their nutritional needs. The e-grocery market is largely preferred by millennials as they are majorly influenced by shopping trends with their active usage of smartphones. There are different kinds of products sold online such as food products; beverages; cosmetics; personal care and baby care products; stationery items, household goods, and others. Staple pantry items have emerged to be the most extensively sold items, and the segment is estimated to register a compound annual growth rate (CAGR) of 37.40% through to 2025. The global e-grocery market will witness growth owing to the rise of smartphone usage, with the millennial population leading the charge. During the forecast period 2019-2025, the market is evaluated to grow at an outstanding CAGR of 41.24%. The market was valued at $29.57 billion as of 2018.

Online / E-grocery Market Outlook:

The e-grocery market consists of either offline stores that also allow online ordering or standalone websites that only exist online and do not have offline accessible stores. These stores have been gaining popularity as they offer convenience and ease of accessibility. The e-grocery market is witnessing a considerable amount of innovations in recent years. For instance, in 2017, Thistle launched meal kits for making nutritious baby food at home. Most of the key market players such as AmazonFresh and Walmart, exist in North America. This is one of the major reasons why the e-grocery market managed to get its maximum demand share from North America, with the regional share being 61.40% in 2018.

Online / E-grocery Market Growth Drivers:

Ø The Need For A Healthy Diet

According to the United States Department of Agriculture, the lack of a proper grocery store in a person’s vicinity leads him/her to consume more packaged products. The former First Lady of the U.S. emphasized on the need for healthier diets through her campaign called “Let’s Move”. This has been a capitalizing factor for key market players in the e-commerce market as e-grocery websites make grocery available for everyone without the limitation of location.

Ø Ease of Access

Due to the growing population, the necessity for working has become prominent. Nearly all adults of a family are now counted in the working class as they do jobs to make ends meet. E-grocery websites make use of this factor and provide options to let customers browse through groceries online without bearing the physical pain of going outside. This has acted as an important growth driver for this market.

Online / E-grocery Market Challenges:

A prominent challenge faced by the e-grocery market key players is the exorbitant inventory costs. Companies incur massive financial losses in storage and delivery of groceries. A tentative solution to this challenge is state-of-the-art inventory management API that can bring down inventory costs. Pairing up with a reliable delivery service is another way to combat this.

Online / E-grocery Market Key Players Perspective:

Key market players operating in the e-grocery market are AmazonFresh, LLC, Koninklijke Ahold Delhaize N.V., Fresh Direct, LLC, mySupermarket Limited, NetGrocer.com, Inc., Walmart Stores, Inc., Safeway, Inc., Supermarket Grocery Supplies Pvt. Ltd., ShopFoodEx, Schwan Food Company, and My Brands Inc.

AmazonFresh, a subsidiary of the e-commerce behemoth Amazon, is largely preferred by customers for its ease of access. Recently, it introduced AmazonFresh Pickup, which allows consumers to pick up groceries from a location of their choice.

Online / E-grocery Market Trends:

Ø Voice Ordering and Assistant Technology

Automation experts in the industry have predicted a paramount shift from text based searches to voice-based online searches. This will introduce personalization in e-grocery shopping experience as customers might feel that it is equivalent to physically going out and shopping.

Ø Customizable Delivery Options

Since e-grocery shopping is mostly solicited by the working class, there are frequent times when they might not be available at home to receive the products. Prominent market players such as Amazon have started customizable delivery options in which customers can choose whether they want groceries delivered to them in person, at their doorstep, or personally collected from a pre-decided location.

Online / E-grocery Market Research Scope

The base year of the study is 2018, with forecast done up to 2025. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the E-grocery Market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the types of segments in the E-grocery Market, and their specific applications in different areas.

Online / E-grocery Market Report: Industry Coverage

The E-grocery market can be segmented based on product type and demography. On the basis of product type, the market can be sub-segmented into food products and beverage, beverages, cosmetics and personal care, baby care, stationery, and household goods. Based on demography, the market can be categorized into age and gender.

The Online / E-grocery Market report also analyzes the major geographic regions for the market as well as the major countries for the market in these regions. The regions and countries covered in the study include:

• North America: The U.S., Canada, Mexico

• South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

• Europe: The U.K., Germany, Italy, France, The Netherlands, Belgium, Spain, Denmark

• APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

• Middle East and Africa: Israel, South Africa, Saudi Arabia

For

more Food and Beverages related

reports, please click

here

2. Global Online / E-Grocery Market - Executive Summary

3. Global Online / E-Grocery Market Landscape

3.1. Market Share Analysis

3.2. Comparative Analysis

3.2.1. Product Benchmarking

3.2.2. End User Profiling

3.2.3. Patent Analysis

3.2.4. Top 5 Financial Analysis

4. Global Online / E-Grocery Market Forces

4.1. Market Drivers

4.2. Market Constraints

4.3. Market Challenges

4.4. Market Opportunities

4.5. Industry Attractiveness

4.5.1. Power of Suppliers

4.5.2. Power of Buyers

4.5.3. Threat of New Entrants

4.5.4. Threat of Substitution

4.5.5. Degree of Competition

5. Global Online / E- Grocery Market – Strategic Analysis

5.1. Value Chain Analysis

5.2. Pricing Analysis

5.3. Opportunity Analysis

5.4. Product Life Cycle Analysis

5.5. Suppliers and Distributors

6. Global Online / E-Grocery Market– By Product Type

6.1. Food Products

6.1.1. Fruits and Vegetables

6.1.2. Dairy Products

6.1.3. Staples

6.1.4. Bakery and Confectionery

6.1.5. Meat and Seafood

6.1.6. Frozen Food

6.1.7. Others

6.2. Beverages

6.2.1. Alcoholic Drinks

6.2.2. Non-alcoholic Drinks

6.3. Cosmetics and Personal Care

6.4. Baby Care

6.5. Stationery

6.6. Households

6.7. Others

7. Global Online / E-Grocery Market – By Geography

7.1. North America

7.1.1. U.S.

7.1.2. Canada

7.1.3. Mexico

7.2. Europe

7.2.1. U.K.

7.2.2. Germany

7.2.3. Italy

7.2.4. The Netherlands

7.2.5. France

7.2.6. Rest of Europe

7.3. Asia-Pacific

7.3.1. China

7.3.2. South Korea

7.3.3. India

7.3.4. Japan

7.3.5. Australia & New Zealand

7.3.6. Rest of APAC

7.4. RoW

7.4.1. South America

7.4.2. Africa

7.4.3. Middle East

8. Global Online / E-Grocery Market Entropy

9. Company Profiles

9.1. Company 1

"*Financials would be provided on a best efforts basis for private companies"

10. Appendix

10.1. Abbreviations

10.2. Sources

10.3. Research Methodology

10.4. Expert Insights

Email

Email Print

Print