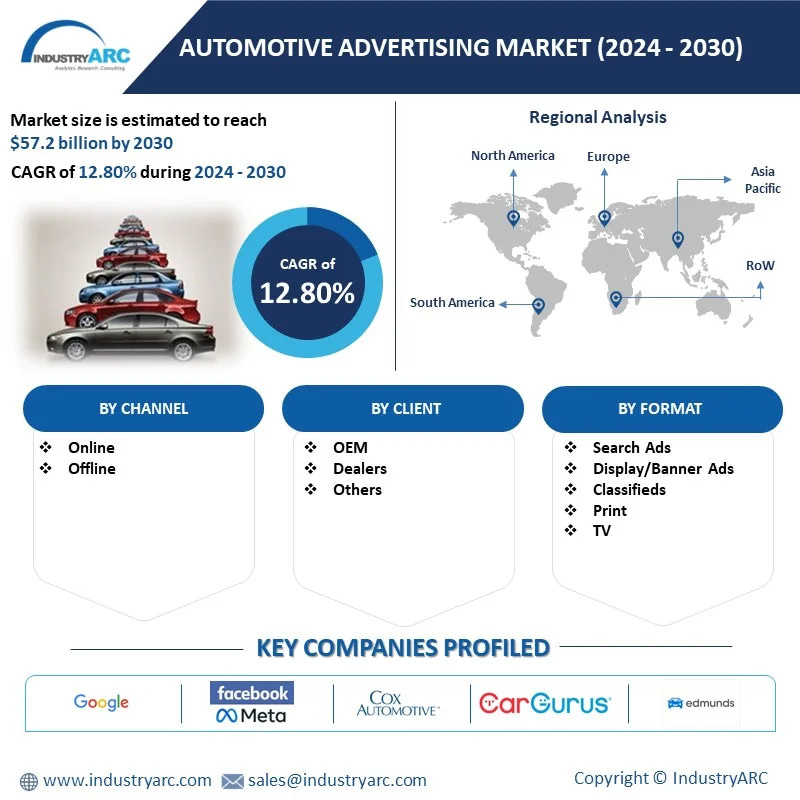

1. Automotive Advertising Market - Overview

1.1. Definitions and Scope

2. Automotive Advertising Market - Executive Summary

3. Automotive Advertising Market - Comparative Analysis

3.1. Company Benchmarking - Key Companies

3.2. Global Financial Analysis - Key Companies

3.3. Market Share Analysis - Key Companies

3.4. Patent Analysis

3.5. Pricing Analysis

4. Automotive Advertising Market - Start-up Companies Scenario

4.1. Key Start-up Company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Venture Capital and Funding Scenario

5. Automotive Advertising Market – Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing Business Index

5.3. Case Studies of Successful Ventures

6. Automotive Advertising Market - Forces

6.1. Market Drivers

6.2. Market Constraints

6.3 Market Challenges

6.4. Porter's Five Force Model

6.4.1. Power of Suppliers

6.4.2. Bargaining Powers of Customers

6.4.3. Threat of New Entrants

6.4.4. Rivalry Among Existing Players

6.4.5. Threat of Substitutes

7. Automotive Advertising Market – Strategic Analysis

7.1. Value Chain Analysis

7.2. Opportunities Analysis

7.3. Market Life Cycle

8. Automotive Advertising Market – By Channel (Market Size – $Million/$Billion)

8.1. Online

8.1.1. Search Engine

8.1.2. Social-Media

8.1.3. Automotive Marketplaces

8.1.4. Video and OTT

8.1.5. E-Commerce

8.1.6. Others

8.2. Offline

8.2.1. Radio

8.2.2. TV

8.2.3. Print

8.2.4. Billboards and Outdoor

8.2.5. Direct Mail and Promotions

8.2.6. Events

8.2.7. Others

9. Automotive Advertising Market – By Format (Market Size – $Million/$Billion)

9.1.Online

9.1.1.Search Engine

9.1.2.Social-Media

9.1.3.Automotive Marketplaces

9.1.4.Video and OTT

9.1.5.E-Commerce

9.1.6.Others

9.2.Offline

9.2.1.Radio

9.2.2.TV

9.2.3.Print

9.2.4.Billboards and Outdoor

9.2.5.Direct Mail and Promotions

9.2.6.Events

9.2.7.Others

10. Automotive Advertising Market – By Client(Market Size – $Million/$Billion)

10.1. OEM

10.1.1. New Car

10.1.2. Used Car

10.2. Dealers

10.2.1. New Car

10.2.2. Used Car

10.3. Others

11. Automotive Advertising Market – by Geography (Market Size – $Million/$Billion)

11.1. North America

11.1.1. The U.S.

11.1.2. Canada

11.1.3. Mexico

11.2. Europe

11.2.1. UK

11.2.2. Germany

11.2.3. France

11.2.4. Italy

11.2.5. Spain

11.2.6. Russia

11.2.7. Rest of Europe

11.3. Asia-Pacific

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. South Korea

11.3.5. Australia & New Zealand

11.3.6. Rest of Asia-Pacific

11.4. South America

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Chile

11.4.4. Colombia

11.4.5. Rest of South America

11.5. Rest of the World

11.5.1. Middle East

11.5.2. Africa

12. Automotive Advertising Market – Entropy

13. Automotive Advertising Market – Industry/Segment Competition Landscape

13.1. Market Share Analysis

13.1.1. Market Share by Channel– Key Companies

13.1.2. Market Share by Region – Key Companies

13.1.3. Market Share by Country – Key Companies

13.2. Competition Matrix

13.3. Best Practices for Companies

14. Automotive Advertising Market – Key Company List by Country Premium

15. Automotive Advertising Market - Company Analysis

15.1. Google LLC

15.2. Facebook, Inc. (Meta)

15.3. Cox Automotive

15.4. CarGurus, Inc.

15.5. Autobytel Inc.

15.6. TrueCar, Inc.

15.7. Cars.com Inc.

15.8. Edmunds

15.9. eBay Motors

15.10. Amazon.com, Inc.

15.11. Other Players

**"Financials to the Private Companies would be provided on best-effort basis."

Automotive Advertising Market - Report Coverage:

Automotive Advertising Market - Report Coverage: Email

Email Print

Print